上周,ACm Research, Inc.(NASDAQ:ACMR)的机构投资者看到市值减少了US$10600万,尽管他们获得了长期收益。

Key Insights

A look at the shareholders of ACM Research, Inc. (NASDAQ:ACMR) can tell us which group is most powerful. With 55% stake, institutions possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Institutional investors endured the highest losses after the company's market cap fell by US$106m last week. However, the 22% one-year return to shareholders may have helped lessen their pain. But they would probably be wary of future losses.

In the chart below, we zoom in on the different ownership groups of ACM Research.

NasdaqGM:ACMR Ownership Breakdown August 27th 2024

What Does The Institutional Ownership Tell Us About ACM Research?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in ACM Research. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at ACM Research's earnings history below. Of course, the future is what really matters.

NasdaqGM:ACMR Earnings and Revenue Growth August 27th 2024

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. We note that hedge funds don't have a meaningful investment in ACM Research. Looking at our data, we can see that the largest shareholder is the CEO Hui Wang with 9.0% of shares outstanding. In comparison, the second and third largest shareholders hold about 6.5% and 6.2% of the stock.

After doing some more digging, we found that the top 16 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of ACM Research

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

It seems insiders own a significant proportion of ACM Research, Inc.. It has a market capitalization of just US$1.2b, and insiders have US$151m worth of shares in their own names. That's quite significant. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 21% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Equity Ownership

Private equity firms hold a 11% stake in ACM Research. This suggests they can be influential in key policy decisions. Some might like this, because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taking the company public.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with ACM Research (including 1 which makes us a bit uncomfortable) .

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

标签: 市值

相关文章

-

险资今年举牌30次助力牛市 A股市值首破百万亿详细阅读

2025年保险资金在资本市场的活跃度显著提升。据21世纪经济报道记者统计,今年以来险资举牌动作已达30次,创近年新高,仅次于2015年的62次。同...

2025-08-18 50 市值

-

赣锋锂业:公司为加强公司市值管理工作已制定《市值管理制度》详细阅读

证券日报网讯赣锋锂业5月13日在互动平台回答投资者提问时表示,公司为加强公司市值管理工作,进一步加强与规范公司的市值管理行为,维护公司、投资者及其他利...

2025-05-13 96 市值

-

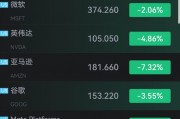

美股七巨头市值两天蒸发1.5万亿美元 苹果市值失守3万亿美元详细阅读

专题:特朗普关税大棒来袭 美股惊现“黑色星期四” 在近两个交易日(从周三收盘至周五开盘期间),美股 “七姐妹” (苹果、英伟达、Meta、谷歌、微...

2025-04-05 84 市值

-

美股科技 “七姐妹” 开盘总市值蒸发8400亿美元详细阅读

专题:特朗普关税大棒来袭 美股惊现“黑色星期四” 美股科技 “七姐妹” 开盘总市值蒸发8400亿美元。 由于美国总统特朗普宣布 “历史性” 关...

2025-04-04 76 市值

- 详细阅读

-

消费和金融助力反弹 A股市值创历史新高详细阅读

炒股就看金麒麟分析师研报,权威,专业,及时,全面,助您挖掘潜力主题机会! ● 本报记者 吴玉华 3月14日,大消费、大金融板块领涨,A股市...

2025-03-15 92 市值